The recent WealthTech Matters event at The Aon Centre in London’s iconic Leadenhall Building couldn’t be more relevant for firms seeking to improve their processes, client experience and profitability through technology. And it’s a fast-changing picture. As the next generation of investors expects everything at the push of a button, the event probed how technology can aid Advisers as they seek to engage with deeper knowledge and greater efficiency across multiple channels.

The opening address to the event revealed that almost 10% of COOs had cited ‘innovation – maintaining the pace’ as the ‘biggest challenge’ keeping them awake at night – second only to ‘achieving greater productivity’ (almost 12%), proving our roundtable topic is front of mind for many: Future-Proofing: How to innovate and adapt in a time of rapid change.

The Wealth Dynamix team were excited to have the opportunity to consult top decision-makers via the session as they sought to tackle one of the most complex yet essential aspects of Wealth Management today: how to future-proof your firm. The conversation started with an overview of the critical themes providing momentum and impetus for innovation – from rising client expectations to Cloud technology, SaaS, and AI.

When surveyed, the dominant driver for change identified by our delegates was the client:

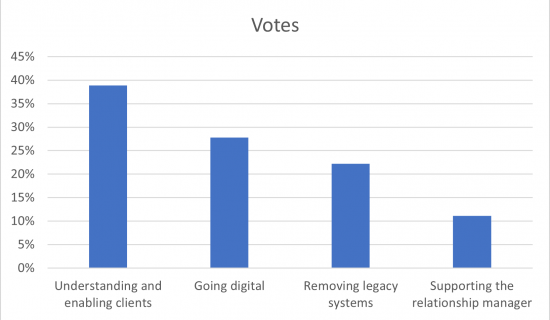

“Based on the assumption that you’re future-proofing your business – what are your key focus areas?”

Almost 40% of delegates actively engaged in future-proofing their business said their key focus was on ‘understanding and enabling clients’ – with less than half this figure focusing on the Adviser.

Digital was seen as a key enabler for delivering efficiency for both the client and the Advisor and a necessary step to driving cost out of the business – in parallel with removing legacy systems.

What does innovation mean to you?

Dominic Snell, Chief Product Officer for Wealth Dynamix, underlined the need to not only innovate but to have methodologies for finding out what your clients want or, more crucially, need. In the current environment, he warned, it’s all too easy to be tempted by shiny new tools. Such commodities were likened to a ‘supercar’ dashboard, which looks incredible but, unless connected to the right engine, might give you a misguided outlook, telling you that you’re speeding along at 100mph when the reality is closer to 60mph.

The subject of innovation often centres on vast transformational projects or ground-breaking technology. Yet, innovation for the average firm could simply be providing a product to a new segment or focusing on systematically eroding common client pain points. It can mean ‘improving on yesterday’ – perhaps a more accessible ethos to uphold and unite teams behind than something as daunting and limitless as continual, company-wide change?

The experiences of our roundtable delegates reinforced the need for firms to not only be vigilant and open to change but to find ways to nurture a pioneering spirit within their company. When asked whose tech teams were ‘at the table, working with the leadership team,’ only 50% of our delegates responded positively, which hints at the challenges in-house technology experts may face when trying to get buy-in for new technologies.

What are the blockers?

While some of the delegates felt the changing regulatory landscape presented an ever-present and unpredictable obstacle to new technologies and ways of working, others confided being stung by past experiences of vendor non-delivery or feeling increasing pressure to focus on cost-savings in 2022. Those working for larger, well-established firms, in particular, expressed little wish to be at the vanguard, naming ‘reliability’ and ‘proven capability’ as the qualities topping their wish list.

This perhaps illustrates the value of early-adopting entrepreneurial-spirited start-ups for the wider sector – smaller and more agile with fewer legacy systems, they may well be in a better position to push the boundaries of the UX. However, even delegates from newer, relatively modest firms expressed frustration at the scale and pace of the undertaking when it comes to transformational change.

Being future-focused is a mindset

Our primary outtake from the session was that innovation needs to be engrained within your infrastructure and culture to happen consistently. The vision, culture and buy-in across the business are all integral, and that will only be achieved through a mindset that actively encourages change.

Just as importantly, our delegates stressed the need for collaboration and the retention of time-earned knowledge – and this is where incumbent firms with established teams and networks may confer an advantage. Used to working together and able to assess impacts across departmental siloes, they are better equipped to adopt a holistic view of wealth management processes which garner efficiencies at every stage of the client lifecycle.

It’s a journey

Just as a protracted onboarding process can cause considerable friction for clients caught up in a seemingly endless information-gathering exercise, future-proofing can feel like an out-of-reach goal for Wealth Management teams. In both instances, we’d counsel continual feedback is the vital factor. As discussed during our roundtable, visibility, progress reports akin to parcel tracking apps – and even gamification will help a prospect understand where they are in their onboarding journey and provide much-needed motivation to progress – By the same logic, Wealth Management teams will only successfully adapt and evolve if their progress is regularly reported and their trajectory is clear.

If you’d like to know how Wealth Dynamix’s consultative approach enables innovation for the next generation of investor in a rapidly changing landscape, whilst managing the needs of the regulator, please get in touch.