In October 2023 Wealth Dynamix announced a new partnership with REGDATA – a state-of-the-art data protection and privacy service. It’s a collaboration that has created an industry-first in wealth management and private banking – a fully tokenised Client Lifecycle Management (CLM) solution in the Cloud.

Here’s a guide to why it matters and what it means for CLMi, our revolutionary, SaaS-based Client Lifecycle Management solution.

The fundamentals of tokenisation

Tokenisation is a process in which sensitive data is replaced with non-sensitive placeholders called tokens. These are typically generated using an algorithm and hold no specific meaning or value. The original data, which might be personal identification details or highly sensitive financial data such as credit card details, is replaced by tokens and cannot exit the secure network in legible form.

A tokenised CLM therefore ensures the absolute security of client data as it leaves the secure network. In the event of a breach, the compromised data is useless to anyone with malicious intent as the tokens cannot be reverse-engineered to reveal the source data without the decryption keys. The key to detokenise is owned by the bank or wealth management firm alone, so only they can view the data in its true unencrypted form.

Adding this ‘zero trust’ technology to CLMi – a cost-effective, cloud-based CLM which requires no bespoke customisation and minimal maintenance – is therefore a huge step for firms seeking to simultaneously boost their operating efficiency and data security.

The underlying threat

The risks of a data breach are particularly high in the wealth management industry, with potential and constantly evolving threats from hackers, ransomware attacks, theft of physical servers and even insiders with malicious intent. And that’s before you even factor in the issues associated with human error by employees.

The impact of a data breach can be far-reaching, inflicting significant damage to a company’s reputation and client retention, confidence and trust. Furthermore, GDPR standards necessitate the notification of the breach to the relevant supervisory authority within 72 hours, and under FCA guidelines, all affected clients must be advised of the issue in writing and offered advice about the ‘protective measures’ they can put in place, ensuring a very public declaration of the oversight and how it occurred. While any breach of a client’s data is a breach nonetheless, you can see the accompanying narrative would be very different between bank and customer when the compromised information was fully exposed as opposed to fully tokenised.

Aside from the immense reputational damage, the cost of a breach is often sizeable. The average loss to a data breach according to IBM Security’s 2023 ‘Cost of Data Breach Report’ is $4.45 million (a 15% increase over 3 years). Yet for banks and wealth management firms, the stakes are higher still, with the same report quoting financial firms’ losses at approximately $5.9 million per data breach. The same research states that ‘82% of breaches involved data in the cloud’ – an alarming statistic for CEOs and CIOs in the sector keen to leverage the Cloud technology for its enhanced agility, cost-efficiency, data security, and collaboration capabilities.

The advantages of a fully tokenised CLM in the Cloud

The new partnership between Wealth Dynamix and REGDATA therefore represents a major step change. Incorporating a ‘gold standard’ of security and compliance via the REGDATA Protection Suite, CLMi sets a new standard for a CLM in the Cloud with capabilities that span security, compliance and a new level of data mastery. Better yet, it is a ‘plug and play’ solution that requires no ongoing maintenance or new business case to be raised, given Wealth Dynamix has invested heavily in its integration into CLMi.

“The REGDATA Protection Suite platform, integrated into Wealth Dynamix’s CLMi application, marks a significant advancement in data protection for banks. It ensures end-to-end data security, covering data in use, in transit, and at rest. It offers dynamic contextual data protection and provides real-time, auditable evidence of security and compliance.”

Nicolas Prince, CEO of REGDATA

How does it work?

As our short CLMi demo showcases, REGDATA dynamically de-tokenises data in real-time as it is pulled back from the servers, ensuring the security of client information whilst also facilitating data visibility for the user. With intelligent controls, how data is revealed depends upon the context in which it is requested. Without REGDATA tokenisation, client data is encrypted upon entry, making details such as KYC information and conversation logs inaccessible to the user.

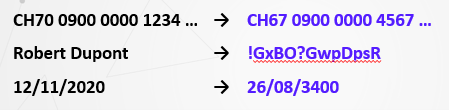

CLMi detokenisation is rare in that it retains the data type (i.e. numbers, letters, date format) as shown in the example below:

This bestows an important side-benefit; it means test data can be made readily available to third parties whilst remaining fully secure, making the implementation and testing of new initiatives and processes far faster.

Advanced encryption options integrate Public Key Infrastructure (PKI) to place control with the firm – allowing management of digital keys and certificates, authorisation to the encryption function and power over which countries data can be encrypted.

Comprehensive data governance and peace of mind

The addition of the REGDATA Protection Suite platform brings peace of mind to industry leaders via a comprehensive standard of data governance which provides auditable proof and effective risk management. Compliance reports can be generated routinely ensuring adherence with regulations to satisfy both regulators and auditors, whilst ‘privacy by design’ adds an extra layer of security to safeguard data across all locations.

Such capabilities, and the ability to adapt readily to future regulatory requirements, enable firms to stay ahead of compliance, adhering to evolving regulations like FINMA, GDPR, and nFADP. The technology is a significant enabler, permitting banks and wealth management firms to pivot to the changing financial landscape without costly and time-consuming upgrades to infrastructure and processes.

Crucially, a fully tokenised solution means the risk of regulatory breaches and penalties is minimised along with the potential for reputational damage. All of these factors combine to create an organisation better empowered to navigate the future.

Over time, firms in possession of this Cloud technology will find themselves able to harness their data and its protection as a catalyst for value creation which supports new business models, operational consolidation, and IT modernisation. Enabled by a single source of data and real-time control over that data, including enhanced visibility for internal teams and readily available test data, further digital transformation initiatives prove much easier to support.

A valuable safeguard

In summary, the scalability, flexibility and power of the Cloud are transforming the operating models of wealth management and private banking, and the creation of a fully tokenised CLM represents the eradication of a critical security hurdle for firms and banks seeking to compete. Knowing client-identifying data will never leave their corporate network, financial institutions of any size can harness the benefits of CLMi Cloud technology to achieve a new standard of data protection and agility.

CLMi is a Client Lifecycle platform which combines best-in-class technology with an industry-leading level of security. Supporting wealth managers throughout the entire client lifecycle via a single data source, intelligent workflows and automated alerts, CLMi aids the scalability, profitability and operational efficiency of the wider organisation. As an out-of-the-box SaaS solution, it can be tested and implemented in a matter of days.