Data capture is a perpetual endeavour for any wealth management firm, but the real challenge lies in extracting meaningful insight from it. This is the challenge facing the modern-day wealth manager, caught up in an age of ever-expanding data and all the responsibility and risk that it brings. From tackling thorny issues like privacy to identifying common drivers for a wealth management data strategy, we hosted a roundtable event to get to the heart of the matter.

Data: for your client, it’s personal. For us, it’s beautiful. While for most wealth management firms, its collection and collation tend to be driven by an ever-evolving raft of industry legislation, compliance requirements and KYC standards.

Yet there’s no doubt that properly organised and maintained client data can result in a swathe of benefits that wealth managers strive for daily. Properly aggregated and analysed in context, this data will help you identify trends and predict changes in client sentiment. And clients who feel genuinely nurtured with relevant services will feel more emotionally connected, yielding greater commitment and in turn an increase in Assets under Management (AuM) over time.

In reality, though, how much of your data’s potential is being left untapped? We decided it was time to find out. Hosting a virtual roundtable on 11 November 2021 at Wealth Tech Matters – The Business, we ran a webinar entitled:

If data is the new gold, how do we unlock the treasure chest?

We asked 14 senior directors – with roles such as CIO, COO and Head of Operations – to give us the benefit of their experience and insight concerning their data strategy journey.

Here we walk you through the main themes and findings; let’s get started.

The key drivers for unlocking data

Unsurprisingly, the promise of one golden source of data was a universally compelling goal. This single source of truth (aka our revered ‘treasure chest’) was viewed as a gateway to acquiring and servicing clients more intuitively, efficiently and effectively.

Unlocking client data was considered a crucial step towards preparing for the increasing expectations of the next tech-savvy generation. A demographic raised on the ever-more-personalised services of big tech, retail and entertainment companies like Apple, Amazon and Netflix.

Broaching likely catalysts for a structured data strategy, it was clear that a combination of interlinked factors is at play.

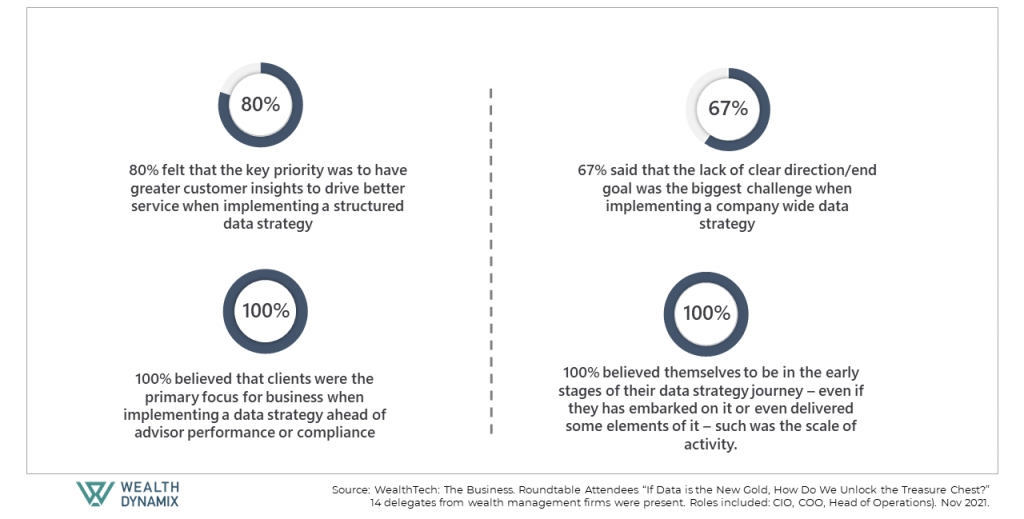

When pressed for one driving force for building a convincing business case, 80% identified ‘greater customer insights to drive better service’ as the critical business need. The remaining 20% of participants elected for ‘the opportunity for increased revenue’.

Placing the client at the centre of your aims

Without exception, client satisfaction was identified as the most significant driver for implementing an effective data solution:

The primary focus for implementation was unanimously agreed. Hearteningly, ‘client satisfaction’ was the main driver for digital transformation and enhancement of the client lifecycle, whether as a means to improve service to existing clients or to attract new ones.

While life stage was felt to be a broadly reliable indicator for predicting client purchasing behaviour, there was a feeling that client attitudes to their personal data can vary wildly. Generally, it was felt younger investors were much more liberal and forthcoming, while some older clients are more cautious, making the client/wealth manager relationship trickier to navigate.

However, it was also observed that many older clients have now adapted to using technology that pre-pandemic, they had routinely resisted.

Education and trust will be essential factors

As the digital transformation of society continues, wealth management firms may see an increase in client concerns concerning the spread of their data. Amongst the group, it was felt that client sensitivity in this area would depend on their level of trust in their relationship manager – a complex marker to define.

The group certainly felt the weight of responsibility associated with being custodians of their client’s data, with worries surrounding cybersecurity and intrusiveness topping their list of concerns.

The future was generally considered bright, though, with generation X and the clients of the tomorrow more tech-literate and possibly open to more self-service aspects of data capture. A helping hand, perhaps?

Conquering the data mountain one step at a time

Many delegates confessed to struggling with legacy systems and old data. In addition to siloed systems that are making data inaccessible or even problematic to locate, this issue is preventing many relationship managers from extracting meaningful information and actionable next steps.

Plans to make improvements in-house were sometimes subject to delay and held in an ‘IT queue’, leading to a feeling of being held hostage by other departments for their data needs. It is, therefore, imperative that firms take a proactive, timely approach.

Conversely, one delegate prioritised a data management team and data warehouse on day one in the job. It was a decision that had since paid off in spades, with a pre-defined format for new data making client onboarding easier, quicker and more cost-effective. Without this alignment, a lengthy 9-month process of cleaning the data would be required. A massive time sink in anyone’s book.

Identifying the key challenges to implementing a data strategy

Given the varying needs of different departments within wealth management firms spanning Relationship Managers on the frontline of client servicing to Operations and Marketing, the path to an effective, fit for use data strategy can feel like a long and winding one.

67% of delegates said ‘a lack of clear direction or a well-defined end goal’ was the biggest challenge they faced when implementing a company-wide data strategy, with 33% citing ‘cultural/staff adoption’ as the primary barrier.

The roundtable discussions revealed many reasons that might contribute to a sentiment of disengagement and poor adoption. These ranged from unclear accountability to entrenched ways of working and behaviours in long-serving employees.

It was concluded that it was often easier to implement data changes into a business in many respects than to change company culture.

Which is best – carrot or stick?

This leads us to the question of incentivisation or simply demonstrating the value of an effective data strategy to relationship managers and other employees. How do the wealth management C-suite engage their teams in this journey and end goal? There was evidence of both carrot and stick approaches among our delegates.

A carrot approach can lead to effective and thorough data capture being tied to the remuneration model; a win-win for all? Yet, with so much data associated with compliance, some companies are taking a firmer stance (a stick approach) to ensure quality data is routinely captured and stored.

At a company level, the benefits of intelligent data are enormous. Beyond mitigating risk via full compliance, our delegates acknowledged that data could solve some traditionally troubling scenarios for wealth management firms. The risk associated with the departure of a long-standing relationship manager, for example, is considerably reduced. With no need for their clients to repeat themselves, they can be reassured and retained.

How to implement your data solution effectively

Once the implementation stage is reached, the delegates agreed it was vital to involve teams and develop user champions. For engagement, it was felt that the optimal solution would need to be highly intuitive and deliver well against pre-defined KPIs.

Another point raised was stability – that the road to a firm-wide data strategy is simply too long for any companies that may be sold in the not-too-distant future. However, as one attendee commented, a defined data strategy can make the acquisition of other companies infinitely easier. The delegate described how handing over their data dictionary and requesting that the newly acquired firm provide data in a specific format had made feeding data into their systems much quicker. This in turn, had provided a much shorter time-to-revenue.

The data journey – a never-ending quest?

Interestingly, 100% of our delegates felt they were at the early stages of their data strategy journey.

Even those who had delivered a data warehouse or outsourced their data management to a third party thought themselves in the initial stages of their data strategy; as one delegate said, “there is always so much more to be done.”

This sentiment underlines both the perceived complexity of the challenge and the nature of the journey: it is often a gradual and cumulative one. This view is wholly understandable. There’s a moving feast of factors from assessing other data sources such as Open Banking to the advancement of technologies such as AI-analytics to consider.

There is a growing sentiment, trend and belief within the industry – for managers to visualise data as a living and breathing asset that will need to adapt and evolve continually. And there’s no time like the present to start nurturing it!

In conclusion, it’s all to play for

Our roundtable delegates acknowledged that data is the key to optimising client lifecycle management through informed actions and touchpoints. And the future is only going one way as clients expect a more intuitive, personal approach along with more access to the data companies hold about them. Yet, without the proper aggregation, segmentation and analysis, your steadily growing data mountain will stand in the way of the fabled treasure chest.

Our final thought? With so many wealth management firms spurred into new ways of thinking by the events of the pandemic, it’s all to play for. Those who embrace a little short-term pain to invest in robust WealthTech solutions that keep pace with the changing digital landscape and the expectations of the next generations will be the ones to reap the rewards tomorrow.

If you feel locked out of your data, it could be time to take some decisive steps to harness it for the future.

We’d love to hear your thoughts.

Where are you in your own data strategy journey?