Having examined why cost control is becoming a business-critical priority for wealth managers in Asia, it’s time to turn our attention to one of the industry’s main cost drivers – customer onboarding, and the know your customer (KYC) and anti-money laundering (AML) procedures that come with it, in an increasingly regulated environment.

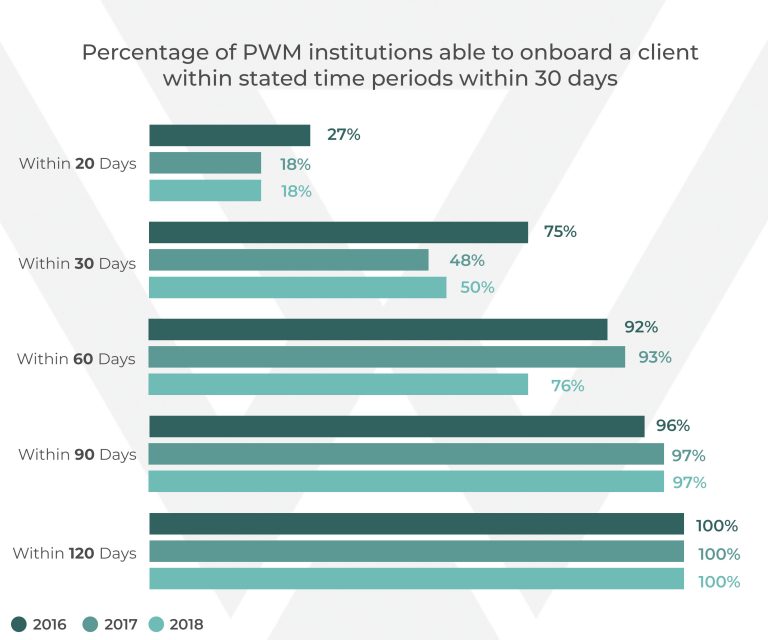

As KYC and AML procedures have grown more complex, the time and investment required to onboard even a single client have surged. A recent report on Hong Kong’s private wealth management industry, for example, showed a full 95% of managers identified KYC and AML as a leading area for resource and budget allocation, and that from 2016 to 2018, the average onboarding time jumped from 30 to 40 days. [1]

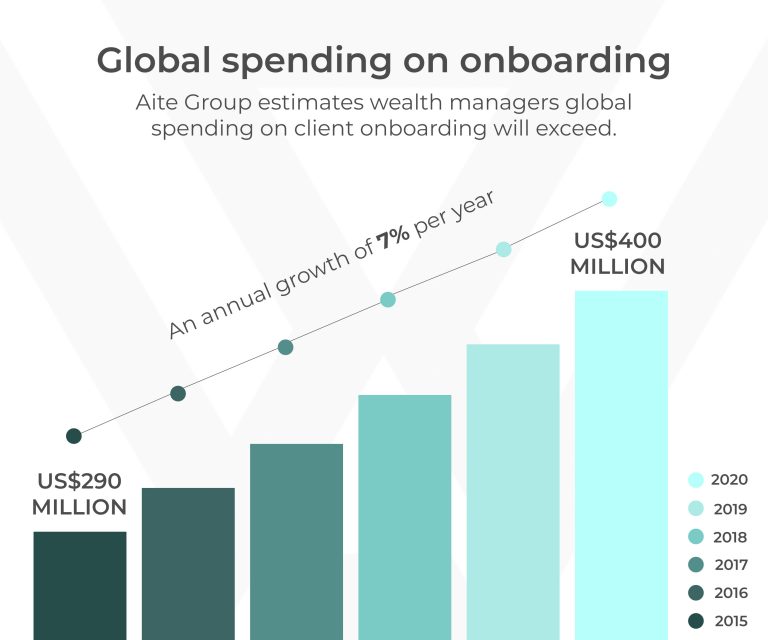

While the precise costs associated with onboarding can vary widely depending on the size of the institution and the jurisdiction, research and advisory firm Aite Group estimates wealth managers’ global spending on client onboarding will exceed US$400 million by 2020, compared to around US$290 million in 2015. [2]

Infographic: The high price of onboarding

Average onboarding time

2016: 30 days / 2018: 40 days

(Source: PWMA/KPMG, Hong Kong) (see footnote 1)

Global spending on onboarding

2015: US$290 million / 2020: US$400+ million

(see footnote 2)

It’s no wonder a lot of managers are worried about legal and compliance spending spiralling out of control. But the difficult truth is the real costs of onboarding are likely a lot higher than we realise. Not only does onboarding force staff to spend an inordinate of time completing manual processes; it effectively leaves would-be clients in limbo.

Stepping into the customer’s shoes

Just imagine how a potential customer accustomed to near-instantaneous service in most aspects of life feels when asked to wait eight weeks to open an account, or is subjected to multiple requests for additional paperwork. The onboarding process can leave someone who was formerly keen to invest feeling like they’re unwanted, perhaps even push them away entirely. Long waits and overly bureaucratic procedures result in frustration and long stretches of dead time. That means in addition to layering on costs, onboarding also results in a lot of potential revenue being left on the table.

The flipside of this rather grim picture is that any improvements to the onboarding process can have massive impacts in terms of reducing costs and creating new income opportunities. And the most effective way to drive those improvements is through targeted, judicious investments in technology.

This doesn’t necessarily mean buying the biggest or most advanced system. What the current environment really argues for is integration – that is, solutions that unite legal and compliance processes on a single platform, so they’re not repeated or redundant, and that forge better connections between the teams overseeing these processes and relationship managers. This kind of infrastructure enables client information to be captured once, used multiple times and instantly shared wherever it’s needed. This all but eliminates rekeying and paves the way for time-saving innovations like the pre-population of account opening forms.

Productivity gains like this alleviate cost pressures and contribute to revenues by enhancing client experience overall. What’s more, by extending integration to functions like prospecting and marketing, wealth managers can make onboarding the introduction to a more seamless, data-driven method of client lifecycle management, where information is gathered and used effortlessly to inform better decisions and ultimately, more productive relationships. When it’s approached in this way, it is possible to be optimistic about onboarding – and to make it much more than a big box to tick.

[1] http://www.pwma.org.hk/Uploads/5c0e04a6c9c38.pdf

[2] https://aitegroup.com/press-release-client-onboarding-wealth-management-vendor-overview