The ability to scale clients and AuM without scaling operational costs proportionally is a defining challenge for today’s wealth management firms and private banks. And it is proving critical for many. PwC’s 2023 Global Asset and Wealth Management Survey projections estimate that ‘by 2027, 16% of existing asset and wealth management (AWM) organisations will have been swallowed up or have fallen by the wayside – twice the historical rate of turnover’, illustrating the sector is in a period of rapid transformation and flux.

Firms able to master their scalability alongside meeting client expectations and retaining and nurturing their internal talent will win out, but what does it mean for the advisor and wider team? It can be tempting to think the rise of technology and increased digitisation of the client lifecycle will mean less internal expertise will be needed, but the reality, for now at least, is the demands of High Net Worth Individuals (HNWIs) are only increasing, necessitating new ways of working that enable the advisor to be more responsive, flexible and customer-centric. Given the added complexity of Ultra High Net Worth Individuals (UHNWI) and HNWIs finances across tax planning, estate planning, succession planning, philanthropic and alternate investments, a dwindling talent pool is being placed under considerable pressure.

The people puzzle

The human element of wealth management is still fundamental to successfully cultivating the advisor-client relationship and fulfilling the requirements of the new Consumer Duty, underlining the need for advisor involvement at key points in the client’s journey.

Indeed, a perceived lack of support can prove a major tipping point. PwC’s 2022 HNW Investor Survey revealed the ‘previous advisor’s inability to support client’s changing financial circumstances’ as the primary driver for investors switching to a new advisor. Headline statistics from the same report suggest it is all to play for, with ‘46% of HNW investors planning to change or expand their wealth relationships in the next 12-24 months’ and two-thirds of HNWIs stating they desire ‘increased personalisation’ during their customer journey. Just as worryingly for incumbents behind the digital transformation curve, it has been reported that ‘around half (51%) of financial advisors are thinking of leaving their organisations for ones with better tech tools’.

The evidence all points one way

The current climate of economic uncertainty and market volatility, evolving regulatory requirements, upward pressure through inflation on costs and downward pressure on fees provides a perfect storm for industry CEOs seeking to expand their operations. However, research and industry sentiment reveal a tried and tested pathway to improved efficiency and cost-to-income ratios. When properly supported with technological solutions that automate many of the manual, repetitive tasks that currently take up 60-70% of advisors’ time, internal teams become more informed, productive and driven.

“Technology can automate processes, free up time for an elevated human role, create better insights from large data sets, and more. Organisations can apply human-centred design digital experiences that make their workforce more productive, and engaged, and help organisations promote wellbeing.”

In short, technology is an enabler that will give time back to advisors for face-to-face client activity, upskilling and prospecting. Additionally, at a time when ‘65% of financial services institutions’ report an expected ‘shortage of critical workers over the next two years’, technology can aid attraction and retention of adequately skilled talent through a vastly improved working environment and a culture that supports a positive trajectory, with a focus on learning, collaboration, informed decision-making and growth.

Scalable technology

A hybrid model is your gateway to faster, fully compliant streamlined processes and automation, driving down the cost of client acquisition and creating time and opportunity for in-person interactions when they are most vital to adding value.

Investment in infrastructure that can accommodate growth without significant incremental costs, including Cloud-based solutions, modular software and APIs for easy integration with other systems, creates agility and added momentum. As a positive feedback loop is fostered through superior customer experience, in turn improving acquisition and retention, firms will find themselves in the advantageous position of being able to scale organically without prohibitive cost.

Partnering for success

Furthermore, CEOs and CIOs contemplating the skills they need to consistently deliver exceptional customer support and friction-right journeys, are beginning to realise that securing the optimal talent pool can mean engaging specialists from outside of the business. It is a shift in thinking that is transforming ‘the dynamics of wealth management.’

Partnering for success is a trend that allows banks to leverage the expertise of a wider ecosystem to adapt for profitability at scale, disrupting the direct correlation between their AuM and cost base. It is a calculated decision that can plug talent and skills gaps and, most crucially, harness a new level of industry expertise, innovation and nimbleness. And it is a strategy that is delivering; today, ‘four out of five of the top 100 banks by asset size have partnered with at least one fintech company’, according to McKinsey & Co.

Building more empowered, diverse and strategic teams

Modern CLM platforms can support internal teams to be more intuitive and responsive, utilising a single source of data to spot exceptional patterns of client behaviour, analyse sentiment, aid a more personalised journey and gradually lay the foundation for a deeper relationship. In this way, internal expertise is augmented and individuals will find themselves better empowered to prioritise customer satisfaction and operate at the top of their game, freed from the overwhelm of manual tasks and administering compliance.

Through capabilities such as e-signatures during the onboarding journey and automated prompts to alert relationship managers to any issues or process bottlenecks, service standards and time to revenue can be vastly improved. Better data quality and insight will also help advisors optimise client portfolios, driving value for the customer and firm alike, and effecting a shift from meeting financial benchmarks to prioritising and supporting clients’ long-term goals. Wealth Dynamix technology deploys ‘next best action’ capabilities to leverage a customer-centric approach over a product-centric focus.

While technology is supporting the digital transformation of processes from front to back office, those at the top should not lose sight of the people fundamentals such as diversity, equity and inclusion. Women are under-represented and underserved within the industry yet account for 32% of the world’s wealth, conferring a real opportunity for those dedicated to fostering teams more reflective of the investment community.

Taking your people with you

Technology alone is not a cure-all; internal teams will require ongoing investment too – via training, digital upskilling and education on the company’s vision and strategic direction. Neglect this and you not only risk leaving your people behind and losing valuable, experienced individuals, but also failing to fully leverage the full capabilities and benefits of your chosen solution.

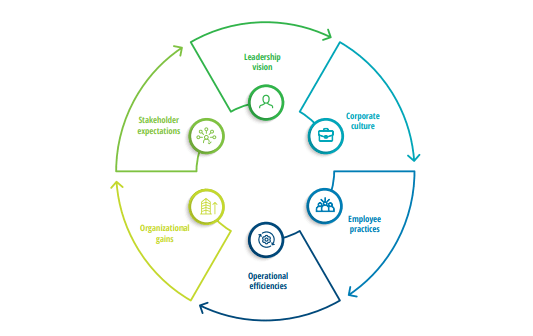

The graphic below from Deloitte illustrates how a virtuous cycle of continual improvement can be created by successfully aligning the vision of leadership with company culture, ways of working, goals and client expectations.

Many investment management firms are driving success in a virtuous cycle

Source: Deloitte Center for Financial Services analysis.

The biggest asset of all

In summary, even with the rise of AI and robo-advice, human wants and needs remain at the heart of wealth management practices, with increasing customer expectations and a desire for digital services in supplement to human advice forcing a re-evaluation of team structure and ways of working. A war for talent has also contributed to the power of the employee as the sector’s experts are well-positioned to go where they feel best supported.

Internal teams supported by digital tools in tandem with effective leadership are equipped to be more flexible, effective and customer-focused, paving a route to profitability at scale. Personalisation is key to achieving trusted client-advisor relationships that promote loyalty, and robust technology will help firms find the sweet spot between human advice and automated processes for a service style that is ownable, compliant and highly attractive to HNWIs and the specialist talent tasked with delivering it.

For a demo of our revolutionary Cloud-based SaaS technology, please contact us.