At the recent Wealth Mosaic APAC WealthTech event in Singapore, Darell Miller shared his view on the evolving landscape and why breaking the link between growing revenue and costs is crucial if firms in the Wealth Management and Private Banking industry wish to scale profitability.

However, as the popular proverb goes, it would seem that for many ‘you can’t have your cake and eat it too.’ In other words, firms face the challenges of scaling without correspondingly increasing costs at the same level.

“It is a truth universally acknowledged that wealth managers, who want to be in possession of a great fortune, cannot grow their revenues and costs at the same time. The profitability ratio needs to scale – thus, the link between growing revenue and costs has to be broken”.

Darell Miller, MD, APACs, Wealth Dynamix

Why this topic and why now?

2022 has certainly been a complex struggle for many in wealth management. Global bear markets, resurgent inflation, heightened geopolitical risks, the tail end of a pandemic, and a full-scale war in Europe have led to challenging conditions to say the least. It has tested many firms in the market and has contributed to the 41% of affluent Asian clients who are expected to switch managers in 2022 (The Future of Asia Wealth Management Series | Accenture).

However, Asia’s leading wealth management firms want assets under management to nearly double in the 2021-25 period, while they also expect revenues to increase by almost 60%.

There are simply nowhere near enough skilled Relationship Managers (RMs) to meet the demand foreseen in the medium term to retain existing customers and grow the proportion of assets under management with them – whilst at the same time attracting new clients. No wonder then that almost 80% of RMs say a solution would be a one-stop platform allowing them to be more efficient and provide better client service (Accenture: The future is calling: How advisory will define wealth management in Asia 2023)

Asia’s wealth management firms have set ambitious goals

Sources:

Accenture: The Future of Asia Wealth Management Series

Accenture’s analysis of just three banks’ growth aspirations suggests they would need thousands more RMs to reach their targets.

This is likely to intensify the war for talent – and one of the ways they will compete is in their ability to empower the RMs through the use of technology.

Managing costs while going for growth

Wealth management firms can potentially learn from different industries with different business models. And these need careful consideration when tackling operational efficiency. What they all have in common though, is how and where to introduce technology.

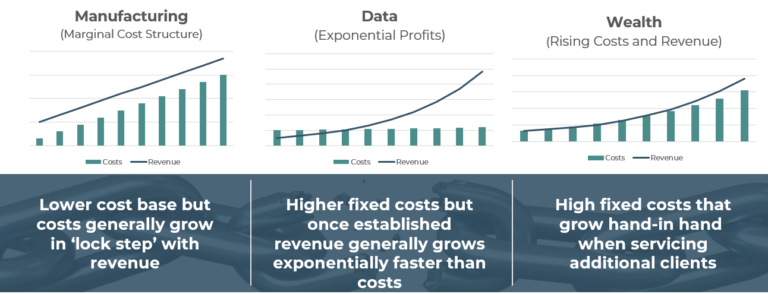

In manufacturing there is generally a lower cost base initially, and as these grow, they generally do so in ‘lock-step’ with revenue. Although more product sales need more raw materials there is some efficiency of scale and therefore the company should become profitable.

For a data-led company there are usually higher fixed costs initially but once the firm is established revenue generally grows exponentially faster than costs due to the ability to be able to sell the same product without the same associated costs.

Now let’s take a wealth firm which has the high fixed costs associated with a data-led firm – and the potential for high revenue – but the traditional servicing methodologies mean that costs rise ‘hand-in-hand’ due to the corresponding costs to serve. These costs are particularly high at the engagement and onboarding stages with new clients so the link in this use case is especially strong and cannot be avoided if firms wish to grow their AUM via new customer growth.

What’s more the increased costs can be felt in several areas of the business – not just for RMs but also in the middle and back-office teams too.

However, the wealth management industry has recognised the need to maintain human contact with clients which provides a high cost to serve but at the same time the industry is grappling with a real imperative to reduce operating costs due to reduced margins.

Breaking the link between increasing revenue and costs is vital

Source: Wealth Dynamix

So, the key to achieving profitability at scale lies in breaking that connection, and this is precisely where hybrid servicing becomes pivotal.

Hybrid client servicing could be the answer

By adopting technology-driven hybrid service models and utilising omnichannel delivery platforms leveraging a solid data foundation, firms can not only enhance productivity and minimise cost, but also secure their survival in the industry.

In a nutshell, by embracing hybrid processes, RMs can effectively expand their client base and assets under management.

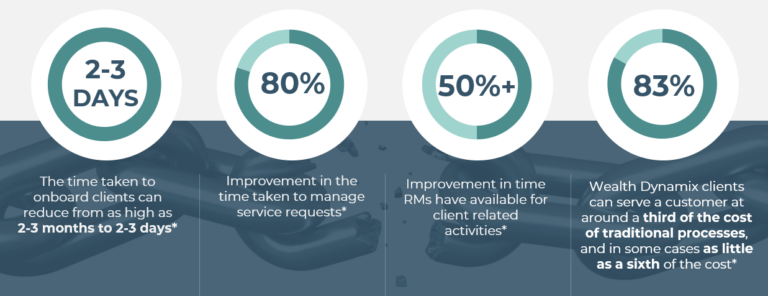

Taking the onboarding use case, a firm that introduces digitised processes into this stage can hope to reduce the elapsed time to onboard a typical client in the region from two to three months, down to two to three days – with our clients reporting that in some instances it can be completed within a single day.

How? By having pre-defined and parallel processing as an example, the use of a client lifecycle management solution can provide an 80% improvement in time taken to manage service requests – and more complex process can also benefit with a 50% improvement in the effort required to complete.

This doesn’t mean that the RM is not required. A hybrid model uses the RM where their expertise is required. But removes the burden of administration whilst ensuring that all actions are completed in a compliant manner.

Creating opportunities for RMs to better serve their clients

Source: Wealth Dynamix studies undertaken with clients globally

Many firms think that the benefits can be incremental – but in reality, they could provide step-changing benefits and secure their firms ability to compete by retaining customers, RMs and attracting new ones.

Integrating a client lifecycle management solution into any private bank or wealth management firm is a complex process which is why Wealth Dynamix undertakes a comprehensive study with all its clients ahead of implementation – whether this is for onboarding only – or to provide a digital transformation along the entire client lifecycle.

If your strategy involves expediting growth or efficiency, or both, click below to book a no obligation consultation to see how your firm could benefit.

READ OUR INSIGHTS

17 April 2024

Achieving profitability at scale: the potential for AI

We delve into the use of AI technology in wealth management. Far from belonging to a far-distant future, it is here and growing more intelligent by the day.

5 min. read

2 April 2024

Empowering client-facing relationship managers and advisors: Perspectives from Wealth Dynamix’s APAC head

Hubbis recently hosted a digital dialogue focusing on the application of the latest digital solutions for the Relationship Managers and advisory in the world of Asian wealth management, as technology revolutionises the offerings and efficiencies across the broad wealth management community in the region.

5 min. read

19 March 2024

Navigating the challenges of scaling through technology

Avoid buyer’s remorse with an upfront analysis of the challenges of modernising your technology stack for greater scalability. Join us as we unpack the issues and give you some pointers.

5 min. read