Scaling successfully organically is all too rare in the wealth management sector. Given the characteristically high cost-to-serve, internal costs will usually rise in direct correlation with AuM unless a path towards a ‘low-cost, high value’ offering is identified that prioritises operational efficiency and service quality whilst capping or reducing costs.

It is, therefore, incumbent on wealth management CEOs to make an ‘explicit choice to grow’ to reap the associated benefits of sustainable, profitable growth.

Given the current level of client expectation and downward pressure on fees, the high cost-to-serve, impacted by everything from client acquisition and onboarding costs to staff costs, IT costs and fixed costs such as compliance and the CIO Office, can create a scenario in which the minimum profitable cost-to-serve is increasing. This can force firms to drop certain client segments or clients with negative profitability based on their future potential. This in turn can result in a negative spiral, with firms unable to grow profitability or AUM, as smaller clients are dropped and advisors struggle to turn even a growing client book into profit growth.

Making growth achievable

So how can company leaders proactively plan for profitable growth? Only through a thorough assessment of daily operations and internal processes, plus bottlenecks, inefficiencies and errors. Yet for firms seeking to scale whilst caught up in the compliance challenges and time-sinks associated with delivering the hyper-personal level of service expected by their HNWI clients, this may appear a dauntingly complex and time-consuming process.

As WealthTech experts who partner with private banks and firms globally to improve their efficiency and scalability through technology, we have compiled a tried and tested blueprint to help outline the steps required. After all, the advantages profitable growth can provide extend far beyond your bottom line as summarised by McKinsey.

‘When sustainable, inclusive, and profitable growth becomes a conscious, resolute choice, it shapes decision-making across every area of the business. Growth becomes the oxygen of an organisation, feeding the culture, elevating ambitions, and inspiring a sense of purpose.’

Technology confers new possibilities

It’s important to acknowledge that taking action to improve scalability requires long-term vision and an adaptable mindset. There may well be some revelations for firms that have yet to harness the advantages of automation and technology. Today’s firms have more tools and Cloud technology at their disposal than ever, adding to the pressure to embark on a technology-led transformation but also, more positively, making improvements far faster and easier to implement.

Purpose-built, out-of-the-box technology such as the Wealth Dynamix solution CLMi already exists, necessitating a thorough assessment of the role of automation and its potential value. It is now wholly possible to leverage digital tools to implement client self-service capabilities where appropriate, to ensure ‘compliance by design’, and to streamline processes throughout the client lifecycle. But before taking steps to secure a solution to better utilise client data and streamline core processes such as onboarding or client reviews, it’s vital to ensure the choice of technology is driven by your strategy and the opportunities available to you.

The Wealth Dynamix blueprint for improved performance and scalability involves a 4-step plan.

1. Assess where you are

The first stage of a mindful transition towards improved ways of working and profitable scalability necessitates an honest look at the status quo. This means understanding what tasks and processes are necessary and which lie at the root of inefficiencies or service failings. This intel-gathering phase should not be hurried and needs to look beyond the obvious issues. Many businesses identify a team of change champions to ensure the findings are properly scrutinised across the different parts of the client lifecycle and company.

A fair and accurate assessment of where you are will be determined via an understanding of not only how long all key tasks take, but through a considered review across all functions. For example, a questionnaire may inquire exactly how long meeting preparation takes. Advisors may casually state 30 minutes when, in fact, the total resource time is closer to 3 hours when the time invested to gather, check and input the information into a report is factored in across the relevant teams. Only through this kind of process-driven thinking will accurate data – and, just as importantly, valuable insight into where improvements can be sought – be captured.

2. Identify your strengths

The next step is just as critical and involves arriving at a vision for your firm and service delivery. By analysing your strengths and DNA as a company, and fully researching and recognising your clients’ wants and needs through segmentation, a long-term strategy for growth that builds upon these factors can be devised.

A move from a traditional wealth management model to a hybrid style of servicing enables firms to retain the human touch their clients value whilst handing time back to the advisor through the efficiencies created by digitisation and automation. Time previously invested in repetitive administrative tasks can be greatly reduced, allowing advisors to build closer, more intuitive relationships with clients, increasing perceptions of their dependability, perceptiveness and expertise for improved retention and loyalty.

3. Identify opportunities to scale

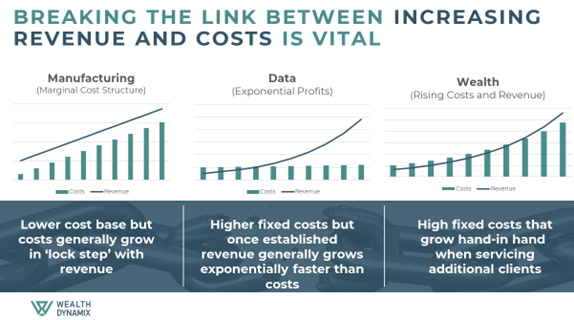

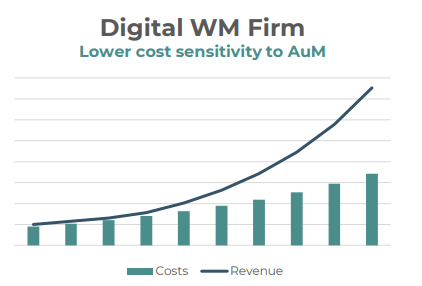

At the heart of every firm’s battle to scale is the need to break the link between increasing revenue and costs. Technology can help redefine that ratio, allowing firms to scale client numbers with little growth in staff, core infrastructure, and fixed costs.

Having put your processes under the microscope in step 1 and identified a direction of travel in step 2, the third stage necessitates a careful assessment of where, and in turn, which, digital solutions will add the most value for both the business and the client. By working through some comparisons with the costings attached, you can define the optimal solution.

‘We often talk about the risk of ‘Bigtech’ and Robo-advisors entering the market, and it’s worth considering, for example, that the Robo-advisor X had Y Staff at X AUM, but only an increase to B Staff at Z AUM, X income with Y on staff.’

4. Scope the cost to the business

The final step involves assessing the cost of your core business processes now and then with the technology in place. Remember that at this stage, a detailed analysis is paramount to accurately scope the true savings available via improved cost: income ratios. Missing details can undermine the validity of the results, meaning that the true potential savings are not revealed. Only through due diligence, a granular approach and the avoidance of the duplication of benefits will a true picture emerge.

Private banks and wealth management firms using Wealth Dynamix technology can serve their clients at around a third of the cost of traditional processes, and in some cases at as little as a sixth of the cost. Discover more about our Client Lifecycle Management solutions today.