At the recent WealthTech Live event by The Wealth Mosaic in Singapore, Darell Miller, Managing Director – APAC, at Wealth Dynamix, talked about the need to scale profitably without costs becoming unmanageable.

In a rapidly evolving market, wealth management firms of all shapes and sizes need to keep up and stay relevant. In Asia they are extremely ambitious as they plan to increase assets under management (AUM) by 1.6x and to grow revenue by 1.4x, between 2022 and 2026 (Accenture). The speed of change is particularly demanding. To remain successful in this competitive market, firms need to scale rapidly – and that means growing the AUM.

Darell Miller, comments: “The opportunity is there. According to Accenture, 41% of affluent Asian clients were expected to switch their wealth manager in 2022. Furthermore, 40% of clients were on the move if they get a better offer. There is also a plentiful supply of younger investors, who are more likely to engage with a professional wealth manager as US$1.9 trillion dollars will be inherited by 2030.”

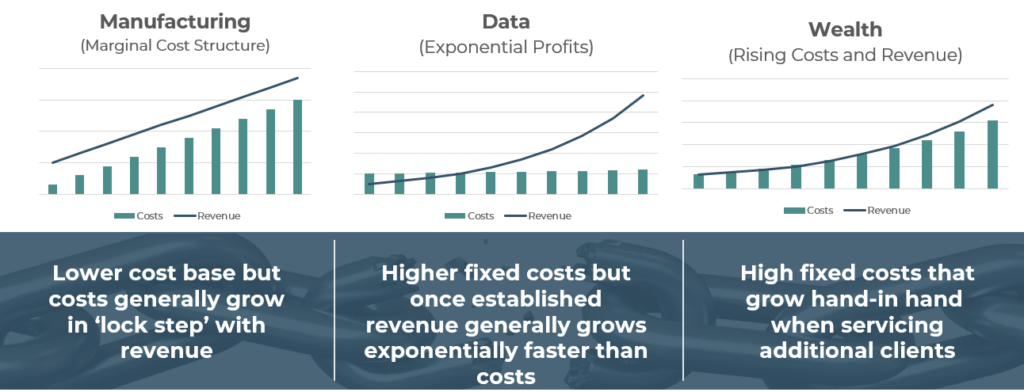

Indeed, achieving scale to meet demand is clearly a common-sense reaction to the market. But the problem with scale is that it is easier said than done. If the costs incurred grow in lockstep with revenue it can cancel out the desired benefits of growth. So, is it possible to scale without costs becoming an issue?

Darell comments: “The three industry challenges that we see, particularly here in Asia, are cost transformation, client centricity, and regulatory compliance.”

He says that it is difficult for wealth managers to achieve profitability at scale because they often find themselves in a situation where continually growing their revenues incurs a simultaneous rise in costs. Growth is imperative, but costs such as hiring more people in all areas of the firm grow hand in hand. In addition to those new costs, the fixed costs of running the business are high because it costs quite a bit to get up and running in the first place. The ongoing maintenance costs are a factor too.

Breaking the link between increasing revenue and cots is vital

He comments: “It is the worst of both worlds within wealth management. It is tough to scale without incurring a mirror in terms of the cost of that scale. IT costs are always there, plus fixed costs and compliance. Furthermore, there are client acquisition and onboarding costs, plus front office and centralised staffing costs which are required to support the business; this is where it all adds up.”

Onboarding

Indeed, in Asia, acquisition and onboarding costs are much higher than in Europe. The average onboarding cycle in the private banking and wealth management scene in Asia is two to three months, and the process is highly manual and contains a lot of friction. The key to this process is capturing the right data and using it intelligently in all other relevant parts of the onboarding and client lifecycle going forward. A capture-once-use-many-times approach means that the same client data can be used by compliance, the document management teams, as well as by the relationship manager to manage the relationship and provide relevant investment recommendations. The way to do this is by having everyone on the same workflow, the same system, and the same client orchestration layer.

“Keeping the data up to date and having a decent set of processes around it can buy back up to 50% of an advisor’s time – freeing them up for more added-value activity”, says Darell.

“Nearly all our clients who put in a solution can serve their customers at a third of the cost of the traditional process – so they take two-thirds out of their cost base. And according to FinExtra, some digital-first firms have reported that they are able to serve their client at a sixth of the cost compared to traditional client servicing models,” he says.

This makes sense from a scale and efficiency point of view, but it is also a common-sense play in that the world is moving to a digital-first proposition. Indeed, before too long mobile apps will be the dominant method of accessing advice; advisors will need to be able to support mobile, as well as all the other channels. For that, the right technology is fundamental.

Darell points out that the supporting technology for the advisor is just as important as the client-facing tasks. “If the client has more information in their hands than the relationship manager that is trying to work with them, then clearly that is not going to work,” he says.

Advisor demographics

Another big issue in trying to scale is finding the right people. Some 37% of wealth managers in the region are expected to retire over the next 10 years (Accenture), and there are not enough people replacing them; that is clearly going to lead to a war for the best talent. Attracting and retaining the best advisors will become an issue, and in this sense having the right technology to attract people and support their efficiency will be crucial and potentially game-changing.

“Powering up your advisors is the way to win the talent war. They are looking for a good technology platform that will support them to be set up for success. So, technology enables you to provide a better solution for your advisors, scale your AUM and profits – and not your costs,” says Darell.

Thus, the key is to arm your advisors with the correct digital tools to provide the very best service possible to all their clients, not just a select few.

Indeed, having both the right people and the right technology allows for intimacy via building long-term relationships, frequent and empathic engagement, relevance, solving key needs in a timely and effective way, perceptiveness, identification of evolving needs, and solutions – the list goes on. Having the right data and understanding it, and not having to spend time on administrative and repetitive tasks enables all this.

He says scaling the best practices across the organisation is transformational. “That is how you get growth at scale without bringing in many more advisors. Our clients are typically able to grow their AUM by 20-40% a year without the same increase in underlying costs”.

A client with better service is more likely to transfer assets from elsewhere, and thus, growth via increased AUM is achievable.

“According to Accenture, Asian clients would put 60% of their total assets with a provider that is giving them good advisory services; it is one of the most cost-effective ways of achieving scale,” says Darell.

He reiterates the importance of service. “Tech-enabled hybrid servicing protects your business because it means you are in frequent contact with your clients who are then likely to hold more assets with you, as opposed to moving assets to another provider who is also trying to scale and attract clients. Everyone is looking to grow – and some will win out at the expense of others,” he concludes.

Are you seeking to create an extraordinary digital-first client prospecting, onboarding, and servicing experience for your wealth management firm?

If you would like to learn about how we can assist, please don’t hesitate to get in touch.