As the wealth management sector seeks new ways to maximise the profitability of their operations without compromising compliance or the security of their systems, many have turned to the Cloud for the agility and flexibility it can bestow.

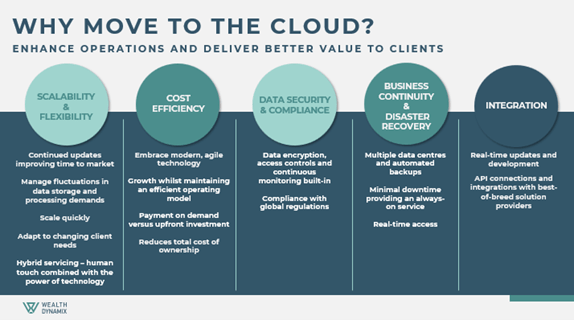

As a CLM solution provider that began on-premises, then moved data to Private and Public Cloud and now delivers Software-as-a-Service (SaaS), Wealth Dynamix has experienced firsthand the benefits of transitioning to the Cloud. From improved efficiency, data security and resilience to greater scalability, harnessing the capabilities of Cloud technology can give you a competitive edge through myriad advantages:

“Overall, migrating to the Cloud empowers wealth management firms with enhanced agility, cost-efficiency, data security, and collaboration capabilities, positioning them to thrive in a dynamic and competitive industry. However, planning and executing the migration carefully is essential, considering factors like data privacy, vendor selection, and potential regulatory implications.”

Cédric Neuville, Director of Pre-Sales & Consulting – EU Wealth Dynamix

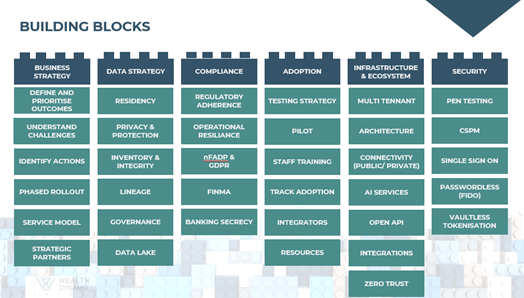

The six building blocks for success

In line with those sage words of advice, it is vital to plan your migration effectively, given McKinsey reports that an estimated 70% of digital transformations fail. Knowing your objectives and the challenges ahead is only one piece of the puzzle – after that, your choices surrounding execution will be critical to a successful implementation.

Adequate consideration, analysis and planning around these six key areas will ensure a sound foundation for the transformation ahead.

Business strategy

It is imperative to analyse where the business is looking to go strategically. By establishing your end goals, identifying the blockers to them and the actions required to overcome these obstacles, you can potentially de-risk your project and, just as importantly, arrive at a vision for the optimal service model for your brand and defined client segments.

At the implementation phase, a measured, incremental approach will help minimise business disruption. Additionally, selecting best-of-breed partners that can accelerate the rollout of the technology and ensure you benefit from lessons learned through their previous implementations will further reduce risk and enable you to reap the game-changing benefits of expert collaboration. In short, using CLM partners who can bring more to the table than technology will help you deliver more, faster. Leverage sector expertise alongside the Cloud, and you can eradicate operational bottlenecks and improve data quality to deliver excellent customer experiences.

Data strategy

With the global average cost of a data breach reported at US$ 4.45 million in 2023 and the potential reputational fall-out a considerable concern, banks, and wealth management firms are naturally wary of storing data in the Cloud. Yet Cloud and SaaS providers are well-equipped for the challenges of protecting your data, utilising dedicated teams and complex encryption and authentication tools to remain one step ahead of existing and emerging risks.

Should the worst happen – for risk can never be negated given human factors such as employee leaks – Cloud platforms can help you recover from incidents faster with in-built DORA requirements for ICT risk management frameworks, active systems for a reduced Recovery Time Objective, and the deployment of nFADP and GDPR principles to ensure data privacy is a priority at every stage of the client lifecycle.

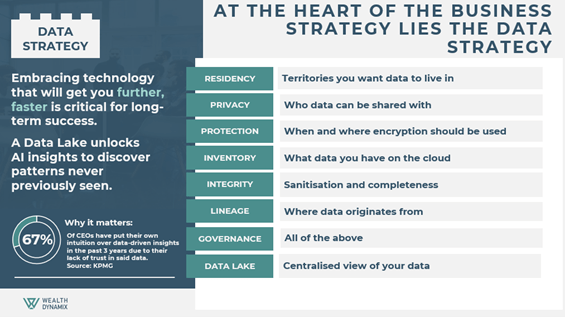

In terms of data mastery, long-term success can be derived from embracing technology that will transform your processes and operating model. And a SaaS solution can support the relevance, accuracy, and integrity of your data at every stage, from assuring the residency of your data – the geographical location of where it is stored – for compliance with data protection laws and regulations, to maintaining a record of inventory and managing what data is accessible to whom.

With a SaaS solution, privacy is in-built; our solutions segregate the data and database for each bank, whilst protection measures such as encryption can be managed by the client owning and controlling the encryption keys.

Increased transparency is achieved by proper data lineage – understanding the source and tracking the movement of data throughout its lifecycle. In turn, all of this contributes to strengthened data governance and, via a data lake, can safeguard the creation of a reliable, centralised repository for reporting and analysing data segments to support more effective and informed decision-making in the future.

Compliance

Every firm faces the ever-advancing march of compliance, but compliance is much more straightforward when you are ahead of it. Encryption, FATCA, CRS, MIFID2 & LSFIN, GDPR & nFADP, operational resilience, and regulatory adherence can all be embedded – we call this ‘compliance by design’, and it is a fundamental capability within our CLM solutions.

The Cloud can supercharge your abilities in this respect. The overriding advantage of SaaS is that your vendor will readily adapt your CLM to comply with the coming regulation, creating the required forms and processes. This drastically decreases the cost of regulatory changes and helps instill a culture of compliance across your systems and teams. Approached this way, compliance is an enabler that can greatly contribute to client trust.

Adoption

Any business change project hinges upon successful adoption. The Cloud is a brilliant facilitator in this respect, removing barriers and reliance on hardware, providing provision for future growth, and allowing faster piloting, rollout, and adoption.

Working with an expert integrator will significantly reduce the risks and burgeoning costs associated with a slow implementation phase. SaaS is your gateway to testing and optimising your CLM at speed. Whilst an on-premises installation will likely take months to install, during which business requirements and challenges can evolve, adding yet more complexity and cost, a SaaS can be installed in a day. This makes it possible to experiment and refine different CLM configurations and workflows quickly, allowing for customisation and collaborative testing via a group of super users who identify any potential issues upfront, thereby minimising the risk of disruption at rollout and contributing to a more robust and cost-effective solution.

However, even with the optimal solution implemented, you cannot assume new business practices will be instantly adopted. A Project Management Office (PMO) should be a strong capability that powers forward any project into any market, identifying the right partners, ensuring adequate testing, training, and tracking adoption and ROI. Neglect this stage, and you are creating an environment in which your teams may struggle to harness the capabilities of your invested solution fully.

Why it Matters

“Slow adoption of data-driven practices results in advisors spending 60% – 70% of their time on non-advisory tasks.”

McKinsey

When deploying a system for a large private bank in Switzerland this year, our change implementation process provided comprehensive management-level reporting that showed who and how the system was being used – or not. This real-time reporting allowed the client to educate, embed and realise the efficiencies of the solution faster.

Infrastructure & Ecosystem

Cloud technology can offer considerable cost advantages over on-premises wealth management systems in terms of infrastructure and ecosystem, eliminating the need for significant investment in new hardware or IT resources to manage servers on-site, plus system updates, security, management, and routine maintenance all taken care of by the SaaS provider.

With software updates and patches the responsibility of the SaaS provider, firms are freed from the mammoth task and financial burden of managing the infrastructure themselves. The optimal CLM partner will also enable their clients to enter into a continual improvement process as the latest advancements are applied without effort or additional resources on their part. With the rise of AI, this could mean the assistance of ChatGPT to write your client emails in a fraction of the usual time, for example, as this type of technology can’t really be easily deployed locally.

However, moving to the Cloud does not have to mean a wholesale change of your infrastructure – modern solutions offer excellent integration capabilities and you can take the best of what you have and use Cloud technology to build on it. Selecting a blended deployment model to make the most of your in-house systems and experience will reduce friction while simultaneously providing momentum in your move to the Cloud. We recommend employing multi-tenant architectures to bring on-premise and Cloud vendors together to minimise risk and maximise ROI.

An excellent example is how Document Management Systems, portfolio management, and core banking can be integrated with a CLM for a complete and rounded solution.

Security

Transitioning to the Cloud does not equate to a loss of control. Reputable Cloud and SaaS providers will leverage built-in compliance features, robust security measures, data encryption, access controls, and continuous monitoring, often surpassing what individual firms can implement on-premises. Implementing better data controls can take your business to the next level.

By working with Zero Trust integration designs, we’ve helped our customers maintain a point of control of data flows between vendors. Such an ecosystem will allow you to embrace new technology and boost data integrity while optimising existing technological infrastructure.

“The Cloud could be a silver bullet for your data privacy and controls. Whilst security fears often top the list for CEOs considering a migration, the reality is that encryption keys can be highly protected, as can the data you share via vendor integrations. Vaultless tokenisation and zero trust put you in control of Personally Identifiable Information when it’s stored outside your data centre, protecting it as it disperses and spreads into third-party vendors.

Use these to stay in control of who can view your data, and unlock opportunities to use new tools and platforms.”

Richard Churchill, SaaS Engineer/Architect, Wealth Dynamix

Ready to harness the advantages of the Cloud?

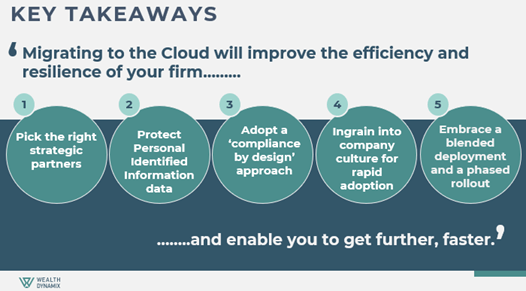

In conclusion, proper consideration of these six fundamental building blocks can result in a Cloud solution that is greater than the sum of its composite parts, boosting operational efficiency, profitability, and resilience. Here are a few summarising thoughts:

If you would like to learn about how we can assist, please don’t hesitate to get in touch.