Let’s begin at the beginning – Why does scalability matter?

Scalability is the ability of a firm to grow its clients and assets, without its costs rising in proportion. This article leverages our experience at Wealth Dynamix within the wealth management & private banking industry to explore the challenges firms face in achieving scalability and provide insights into how digital technology can help firms overcome these challenges.

Why now?

2023 has seen a convergence of macro challenges, from rising inflation, increased market turbulence, to a retiring advisor base with almost one in five say they are likely to switch to a new employer within the next 12 months and an increase in the costs associated with managing and monitoring compliance. These all act as a drag to the profitability of firms.

But there are opportunities as well, with global wealth management and private banking revenues expected to double to $500bn by 2030 (Bain & Company), increased client switching and the intergenerational wealth transfer with $1.0trn moving in the same time frame (Wealth-x).

To be able to capitalise on this, firms need to be able to solve their cost challenges, and to be able to service more clients, with more tailored engagement levels, and with lower operational costs.

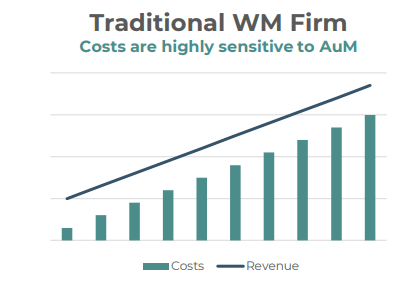

One of the most significant challenges facing firms today is how to grow AuM, without a matching growth in their cost base.

The profitability ratio needs to scale, and the direct link between growing revenue and costs

has to be broken

Breaking the link between increasing revenue and costs is vital

So, what we do we mean by breaking the link? In a traditional firm, sometimes it can feel like every time you add a client, you need to add a staff member. This means that growing client numbers lead to increasing advisor costs, as they can’t manage additional clients, but also in particular a rise in operational costs, with the size of such teams highly sensitive to the number of clients. In the worst cases, scale results in firms breaking through a threshold, with costs then rising faster than revenue, and previously profitable firms moving into the red.

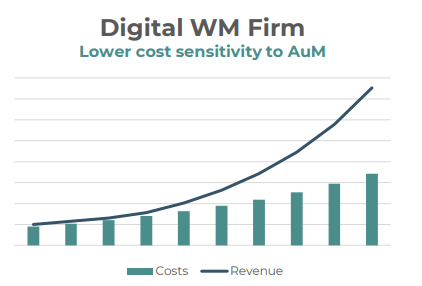

Digital firms use technology to help break that ‘sensitivity’ link, allowing you to scale client numbers, with increased costs focused only on additional advisors when needed, with little growth in operations and fixed costs.

The challenges to delivering profitability at scale

For a wealth management firm the key issue is the link between a greater number of clients and a corresponding higher cost to serve.

Only when the link is broken can firms hope to scale profitably.

There are several factors that lead to increasing costs when a business is trying to scale. Let’s look at some of the key causes, from:

- The cost of client acquisition – with onboarding costing up to 5k a client and taking over 4 weeks, advisors can be put off onboarding new clients, with this acting as a ‘new business blocker’

- Front office staff costs – with advisors spending between 60-70% of their time on non-advisory activities – and not on adding value (McKinsey).

- Centralised staffing costs – with 2-3 support staff for each advisor, and the need to scale these teams in-line with clients, but with many activities often adding little client value.

- IT costs – for example with existing legacy platforms poorly scaling as staff costs increase

- Fixed costs – with compliance teams spending too much time on unfocused investigative work, rather than targeted interventions.

And for firms to capitalise – they need to solve the challenges between client growth and cost growth. Additionally, for firms considering growth through acquisitions, a closed technology architecture can lead to major issues, leaving them unable to integrate their new purchases, and carrying additional costs to report on and manage the combined entities.

Driving scalability – building competence in each area and providing the tools needed to drive efficiency

There are four key enablers which can drive up scalability as a firm grows – and includes empowered teams, efficient processes & systems, data driven insights and scalable technology.

Empowered teams include the ability to attract and retain skilled employees who are adaptable, innovative, and share the company’s vision – and then develop a culture that supports continuous improvement and collaboration.

Standardised processes and automated systems involve the implementation of more efficient processes that can scale as the company grows, as well as minimising inefficiencies caused by split and inconsistent processes.

Data driven insights means establishing a culture of data-driven decision-making by collecting, analysing, and utilising data to inform strategic choices and improve operational efficiency – enabling a pro-active and focused compliance model and enables operational staff to be more efficiently deployed across bottlenecks.

Underpinning this is investment into scalable and agile technology, accommodating growth without significant incremental costs, and enabling ‘self-service’ capabilities where appropriate for clients.

With the right tools and teams, a new culture emerges – one which works without siloes, which challenges the status quo, and which is not accepting the way things are, but as they could be.

Taking the client onboarding use case as an example – by which we mean the transition of a prospect into a client – the process involves the collection of a myriad of different items of information and documentation, complex processes depending on client circumstance, need and structure.

A traditional firm’s wealth manager or advisor will use paper processes and manual checklists to navigate the journey relying on taking and receiving personal instruction, posting documentation or waiting for their return.

A digitalised firm will benefit from a “collect once use many times approach to data” will be able to use said data to develop insight and then use this to propose the right documentation and products to the customer in an appropriate way at the appropriate time. A more thorough review of how WDX can help you achieve this is explored here.

Wealth Dynamix can take a process which typically takes 14 days to complete to be concluded within the same day, resulting in an increased relationship manager productivity boost of 70% by eliminating administrative tasks.

Mastering scalability

The top wealth management and private banks of the future will be those that master scalability with such firms able to rapidly acquire new clients, and often in segments underserved by competitor firms.

What all of this tells us is that scalability matters. It can break that link between scaling revenue and scaling cost. The key is to reduce the sensitivity of your firm to scale by identifying bottlenecks and inefficient process that impact your cost to serve – use technology as an enabler to this change and finally bring your teams on the journey. The focus is not to do away with roles, but to automate elements that are manual, repetitive, and time-consuming first – as well as streamlining, smoothing and speeding up process as a whole. There is a lot to look forward to with a hybrid servicing model.

If you are you are looking to solve issues around scalability, why not get in touch with our wealth management and private banking experts, who can work with your to design a scalable and digital first operating model, leveraging our leading Client Lifecycle Management solutions.