Following an industry-wide countdown, the Consumer Duty is here, and it’s here to stay. Compliance with the new regulations sets a new expectation for the sector. A key element of the duty is data and gathering, monitoring, and acting on this source consistently across the client lifecycle has never been so crucial. So, where should wealth management firms start?

Of course, huge data repositories in themselves are not the aim. In the much-quoted words of Carly Fiorina, former CEO of Hewlett Packard, “The goal is to turn data into information, and information into insight” (Infragistics). And herein lies the crux, the FCA would like firms to prioritise data and Management Information (MI) to ensure they are meeting client outcomes, provide value consistently across all segments and act to prevent ‘foreseeable harm’. This requires consistent reporting and mining of information, but the accuracy of that data is fundamental to achieving an accurate view. Data only harnesses invaluable insight if it is clean, organised and up to date.

Robert Roome, Chief Strategy Officer, Wealth Dynamix, commented, “A lot of firms are not 100% confident they can gather and report on high-quality data. The only thing worse than failing to monitor and report, is, perhaps, reporting inaccurate data and therefore taking the wrong actions. Firms who focus on good data governance, investing in strong data platforms to manage their client data efficiently with all the conformance and quality checks built in will make massive strides towards meeting the new Consumer Duty.”

Adopting a digital-first mindset

The FCA has declared its commitment to its digital innovation and in 2021, pledged a £120m investment in its own data strategy ‘for the next 3 years’ (FCA). Setting out their ‘vision for the use of data and analytics at the FCA’ in their 2022 Data strategy update (FCA), they aim to not only ‘set a new standard’ but to ‘become a more innovative, assertive and adaptive regulator’ (FCA).

Given the digital trajectory of the sector, it is essential that wealth management and DFM firms follow suit to get their own houses in order, and quickly, given the ramifications of data inconsistencies or flaws. Perhaps even more pertinently to the Consumer Duty, within the FCA’s ‘one month to go’ guidance (FCA), they asked firms to consider 10 questions in particular, data, MI and an ability to report, analyse and test was intrinsic to all. Firms which have failed to invest in optimal technologies to allow for accurate data capture and consistent reporting to shield their clients from undue risk are at a critical point in their evolution.

A digital-first mindset will assist wealth managers and marketers as they prioritise what data is important and valuable, in turn raising the bar for KYC and the client experience. In this way, firms can create a feedback loop based on client data which identifies emerging risks, trends or opportunities and allows FAs to act swiftly in response or senior management to take action. This feedback loop is integral to the Consumer Principle, The Four Outcomes, and the Cross-Cutting Rules, which have been designed to provide added protection for the customer, build trust in the sector and push financial institutions to prove the value of their proposition.

Gathering, monitoring, and actioning your data

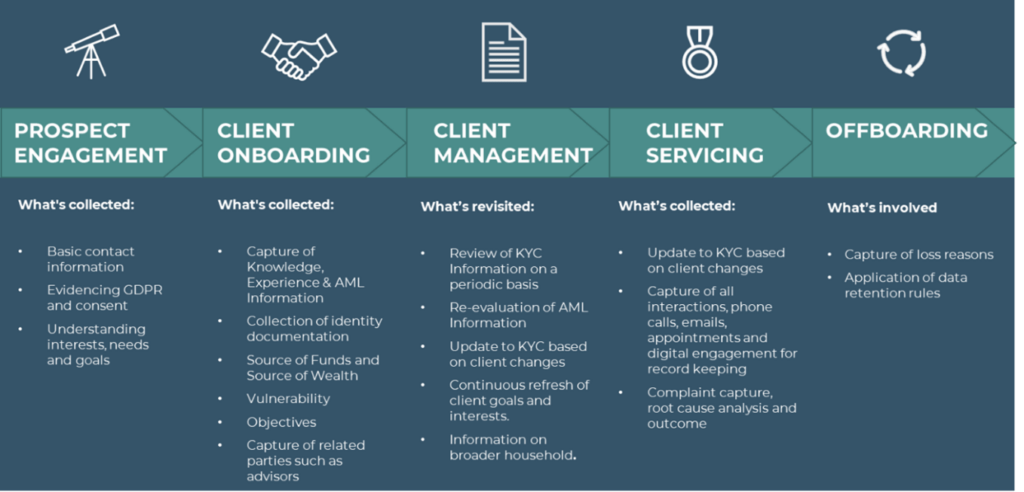

If you’re still collating data in different silos across front, middle, and back office, a more cohesive approach is the way forward. A client lifecycle management (CLM) solution could confer many advantages when it comes to meeting the new Duty and harnessing efficiencies. By assuring a quality company-wide data source and embedding compliance into the client lifecycle, from prospecting through to onboarding and account management, a superior and fully compliant level of service can be achieved.

With Wealth Dynamix much of the data needed to be collected for Consumer Duty is already engineered into the system, called ‘compliance by design’. High-quality data is collected around client objectives and outcomes, continuous monitoring is supported in addition to board-level reporting, and risks are minimised by the technology’s robust processes, client profiling and high-risk indicators.

Wealth Dynamix functionality supports the FCA’s vision

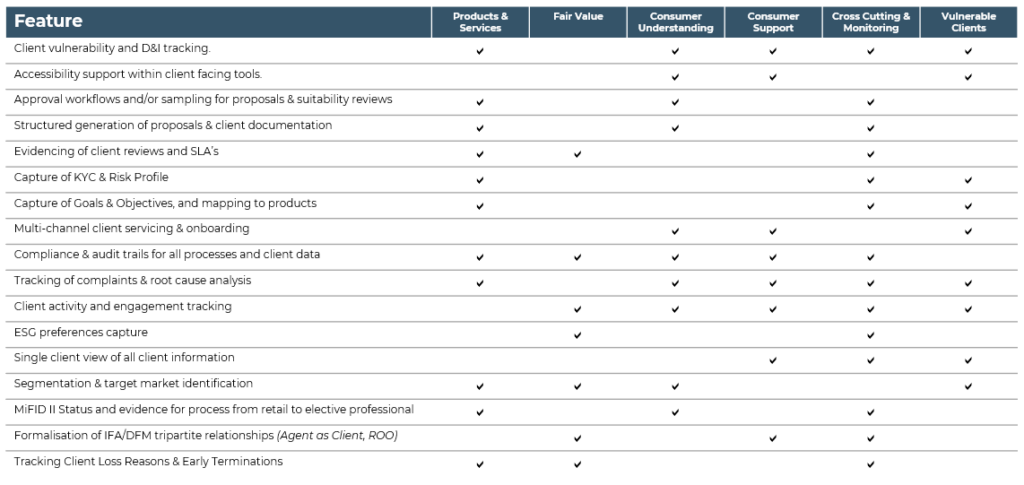

Chapter 11 of the FCA’s Final non-Handbook Guidance for firms on the Consumer Duty makes clear that “A key part of the Duty is that firms assess, test, understand and are able to evidence the outcomes their customers are receiving”. It also unpacks the ‘types of information firms may want to collect’, and it is broad ranging, including everything from customer retention records, vulnerable clients and behavioural insights to complaints analysis, file reviews, research, and staff feedback.

How a Client Lifecycle Management (CLM) system helps

Wealth Dynamix solutions already support the vast majority of these reporting and analytics challenges, as illustrated above, while a configurable framework allows flexibility to adapt to the nuances of your business. Three key capabilities ensure the standards required to meet the new regulatory benchmarks:

A single source of truth

Supporting the new Consumer Duty via:

- An efficient ‘capture once, use many’ approach to data management helps to eliminate disparate silos and minimise manual processes.

- Improved client servicing and overall client experience, with less friction and advisors gaining more time to support clients strategically and add value

- Data required to meet regulatory obligations is captured just once, as quickly and easily as possible, and can be re-used to add value throughout the entire client lifecycle.

- Structured capture of KYC Information, including client vulnerability and detailed information on vulnerabilities.

Cross-book insight via user dashboards

Supporting the new Consumer Duty via:

- Configurable cross-book analytics and insights to support continual monitoring of outcomes and foreseeable harm.

- Ability to incorporate data from multiple sources into insight visualisations and reports.

- Ability to interact with data; to segment ‘on the fly’ and to filter by characteristics such as vulnerability.

- Ability to drill down from Wealth Dynamix notification or call to action straight into the relevant client 360-degree view.

- Support for seamless navigation to other systems within the firm’s systems stack to action notifications from external sources.

- Configurable workload categorisation and prioritisation logic

A 360-degree client view

Supporting the new Consumer Duty via:

- Detailed, configurable client 360-degree views aid KYC and ‘good outcomes’.

- Ability to interact with the client via their preferred channels (including portals, apps, and mobile chats) preventing data gaps and supporting timely resolution of any issues.

- Ability to navigate across multiple client relationships from a single view and to auto-filter the 360-degree view down to the relevant information for greater insight.

- Insight into all in-progress, completed and scheduled client servicing activities, ensuring tasks aren’t lost.

- Access to the full set of KYC data and the client document library.

- Access to a full interactions’ history, including digital touchpoints, supports the need to track and evidence.

- Consolidated information regarding complaints and client satisfaction to help understand potential client issues.

Wealth Dynamix solutions safeguard data integrity, transform data into actionable insights and support a more intuitive and responsive standard of service. Click below to request a demo.