The traditional wealth management business model is under growing pressure. Today’s wealth managers need to embrace digital transformation to upskill, keep pace and retain the human touch.

Digitisation within wealth management – previously pushed by the business – is now being pulled by the demands of the consumer. The result? A need to rethink and reinvent the wealth management business model.

We’ve seen wealth managers fulfil a role more akin to wealth counsellors throughout the pandemic. Clients are seeking support on their terms through more touchpoints and higher call frequency – if you’re a wealth manager with multiple clients, therein lies the rub. The solution lies in embracing digital technology and leveraging it for best effect.

It’s a challenge that’s bound up in a growing web of considerations and complexities in 2022:

A changing client profile

The profile of a typical wealth management client/investor has changed considerably. It is no longer the domain of the highly wealthy older individual or party of individuals – the new investor is younger, more digitally savvy.

In preparing for the democratisation of wealth, wealth managers must adapt to the types of investors coming into the market (i.e. Gen X and Millennials v Baby boomers). Liable to invest in meme stocks and seek out multiple sources of independent advice rather than rely on one single authority, these investors have the potential to shake up traditional WM practices.

New expectations

The younger client has vastly different expectations in terms of how they seek advice and navigate services:

- The new investor expects more, quicker – they’re used to a different level and speed of return – high and fast versus low and slow (though the cryptocurrency market does bring with it volatility – so it can be fast and low – or zero!).

- The new investor is mobile. They expect to manage and control their finances on the go, on their phone or tablet.

- Ease of use and simplicity is key. If services are not easy to use or navigate, clients will abandon the provider in an instant.

- The new investor wants transparency and “control”. Autonomy is vital, as is access to advice and financial information in real-time.

Therefore, investment in digital needs to be both holistic and fully embedded, while at the interface, only an excellent CX will suffice. A practical solution lies in intelligent technology that allows for a 360-degree view of each client and draws on their behaviours, lifestyle and financial needs to support both the client’s and the wealth manager’s objectives.

An increasingly interoperable market

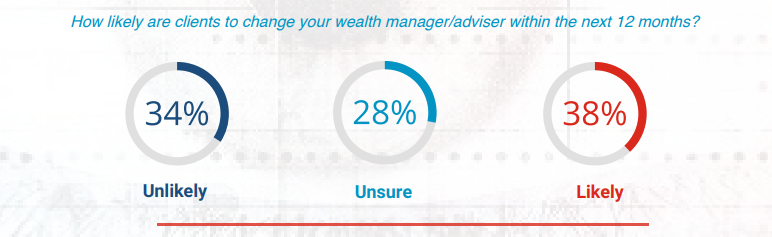

Clients are not only digitally mobile – they’re on the move as a result. A November 2021 report from Compeer noted, “Typically, figures show that anywhere between 10% and 15% of clients are likely to switch providers each year, but in 2021, this statistic shot up to 38%.”

Drivers for moving might include perceptions of a better (or more personalised) service, cheaper fees or the influence of friends or colleagues. To underline the point, CapGemini estimates at least “80% of millennial heirs will seek a new financial advisor after inheriting their parents’ wealth“.

It might seem logical to conclude that digital service elements will degrade the client/ wealth manager relationship over time, yet there’s evidence to the contrary. The recent research paper from Compeer states “clients place far less importance on the firm’s reputation and more importance on the actual relationship itself.” Digital transformation is shaping relationship parameters, though, with the modern client expecting an increased “flow of news, information and updates that may impact their portfolio.”

A wider product set

To prosper, WM providers will need to rethink their service element through a broader product set – not only in the traditional wealth management market (such as ESG) – but also new investment opportunities, including cryptocurrencies and meme stocks. From the gamification of investing through social channels to the grey areas introduced by greenwashing, many of these products introduce added danger for the investor and added complexity for the wealth manager.

Data – leveraging it for best effect

Making sense of client data is a step that’s as vital and ongoing for the initiated as the uninitiated. And remember, you’re dealing with a customer mindset that won’t tolerate failure or settling for second best. Utilising onboarding and continuous client lifecycle data to build a data-driven culture internally and drive a sense of client connection externally will be core to growth. A human touch is still as powerful as ever, yet it needs to be delivered at speed – manual processes alone will no longer be fast enough to support decision-making. A consistent, intuitive service aligned to the client’s personal preferences and beliefs will lay the foundations for loyalty.

The reimagination of the role of the wealth manager

In summary, the role of a wealth manager is morphing with the modern-day client. In 2022, I’ll be intrigued to see how firms conduct themselves away from their ongoing practice, how much philanthropy and buying into the beliefs of their investors play a part and how well trust in the industry holds up.

While the ecosystem and client profile are changing, providers who centre their business strategy around a laser-focused view of every clients’ unique needs will win out – a truth as relevant today as ever. Easing the administrative burden to empower relationship managers through data-driven insights will ultimately hold the key to maximising client engagement and trust.