Managing all aspects of a client lifecycle is a complex process in a wealth management setting, and it’s becoming progressively more so. So how can private banks and wealth management firms face the future with confidence that they can rise to any challenge? In the context of growing compliance requirements, increasing client expectations, broader asset classes and the looming intergenerational wealth transfer, greater efficiency, collaboration and connectivity across the client lifecycle are vital for survival and profitability.

At Wealth Dynamix, we’re proud to say we have 10 years of experience in helping wealth managers tackle these challenges, leverage more revenue opportunities, and serve clients faster and more intuitively through effective, fully integrated, end-to-end client lifecycle management (CLM) solutions. Put simply: we’re in the business of supercharging your business.

10 reasons for 10 years

To celebrate 10 years of exciting innovation, we’ve released our latest e-book, 10 Reasons to Choose Wealth Dynamix, to walk you through the benefits of investing in a complete digitised, intelligent solution devised by wealth management experts.

In a previous iteration, we published 5 reasons. The reasons have doubled, and this is why: just as technology and the economy never stand still, neither do we. Our solutions have evolved to keep in step with the ever-changing needs of the modern-day Relationship Manager, Compliance Manager, Operations Manager and Marketing Professional.

Providing all the tools to support a superior and frictionless client experience, our solutions will help you build on your core strengths and style of service as you pivot to work faster, more intelligently and more profitably.

What sets Wealth Dynamix apart?

As the only truly end-to-end CLM provider in the Wealth Management sector, our solutions aid you in every phase of the client lifecycle, from client acquisition and digital onboarding to relationship management, client engagement and ongoing client servicing. Unlike CRM solutions, our solutions solve more than just one piece of the puzzle. Through a holistic approach, we enable firms to locate efficiencies at every stage of the client lifecycle and offer a consistent, joined-up approach through one data point: a single source of truth.

We’re a global business headquartered in London with offices in New York, Zurich, Geneva and Singapore. We’ve become one of the industry’s leading providers and thought leaders through a proactive, consultative approach. Collaborating and contributing to many industry commentators, most recently including Hubbis, WealthBriefing and The Wealth Mosaic, we keep our fingers on the pulse of the industry.

Choose a Wealth Dynamix solution, and you gain a strategic partner in your success through a team which combines a rich seam of wealth management expertise with in-depth technical knowledge and implementation experience.

With a proven track record in delivering for large international financial corporations, which this year have included Banco Sabadell in the US and Mirabaud in Switzerland, our solutions and people are tried and tested. We have over 40 awards to our name and recently won Best CLM and Best Digital Offering at the WealthTech Asia 2022 awards and the Celent Functionality Award in 2021.

Why now?

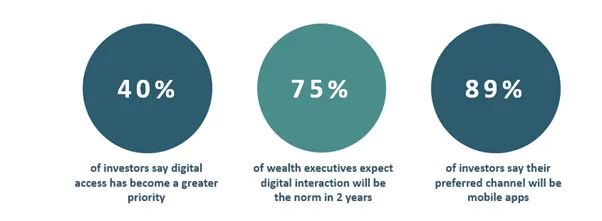

If you’re amongst the thousands of senior stakeholders within banks and wealth management firms struggling with the time sink and escalating cost associated with outdated legacy systems, it’s time to adapt. Standing still has its own cost, plus a digital, hybrid experience is no longer a client aspiration but a baseline expectation. Here are some facts that should not be ignored:

ONBOARDING

Studies show that 68% of clients will abandon the process altogether

if it is too cumbersome

COMPLIANCE

Between 2010 to 2020, the number of regulatory events and organisations tracked for compliance more than quadrupled

CLIENT SERVICING

91% of HNW individuals consider service quality to be an essential

wealth manager selection criterion*

Find out how Wealth Dynamix can help you tackle these trends and maximise the opportunities presented within the client lifecycle with our latest e-book. Spelling out the advantages of a fully digital solution, a single source of truth CLM and more, it’s essential reading for any firm or private bank seeking a competitive edge.

Here’s an example set of KPIs taken from a leading Private Bank we implemented a solution for:

Take the first step in your transformation journey today

We understand transformation projects are never simple. Rest assured that at Wealth Dynamix, we have the capability and experience to help you navigate this critical phase in your company’s development. To fully comprehend the possibilities of the ultimate CLM and foster the right mindset for the transformation of your business, download our e-book now.