The Hybrid Servicing model is growing in popularity as populations become more digitally adept, and a younger demographic of High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) individuals start to impact the current benchmarks for client servicing and the accessibility of their financial data. Yet, not all parts of the Wealth Management industry have readily embraced the opportunities conferred by AI and data-driven insight, with indecision and resistance fuelled by evolving regulatory considerations, the complexity of the wealth management client journey and a long-held belief in the value of human interactions to the service provided.

Wealth Dynamix expert Benjamin Labrousse, Manager Pre-Sales EMEA, took part in an Altfi webinar to investigate how firms can successfully integrate new technologies for increased profitability and, just as importantly, manage the risks of doing so.

The Hybrid Servicing Model

The session began with a look at the characteristics of the Hybrid Servicing model:

“Hybrid servicing allows firms to provide an omnichannel service proposition that provides traditional servicing with modern technology to create a cost-effective and highly differentiated proposition.”

Benjamin Labrousse, Manager Pre-Sales, EMEA

It’s a model which blends traditional advice with self-service platforms, utilising technology as an enabler for greater efficiency and effectiveness across the client lifecycle. Benjamin Labrousse explained the model’s strength lies in its ability to give clients access to their financial data at all times and create ‘stickier’, more persistent interactions without compromising on scalability or the human touch when needed.

Setting the scene

Incumbents reluctant to adapt should take note of three key insights into the future shared by the panel, including:

- Client demand for digital services is increasing – The clients of today (and tomorrow) want digital-first engagement, more transparency and more for less. And a burgeoning client base is there for the taking with a growing number of HNW and UHNW individuals globally.

- Experienced Financial Advisors will increasingly come at a premium – a forecasted shortage of FAs available to serve a growing number of wealthy individuals in future years will present challenges to scalability with a traditional advice model. Some analysts predict that in the US alone, 37% of all FAs anticipate retiring in the next ten years while recruiting adequately skilled talent is becoming ‘a tall task’.

- Human advice is still an essential service element – As technology advances, FAs will shift from product selection to focusing on client engagement, Emotional Intelligence (EI) and even behavioural coaching. AI and Robo-Service have their limitations, and for complex situations, ready access to human-based advice will still be necessary under the Consumer Duty Act.

Hybrid Servicing Balances the Needs of the Firm and the Client

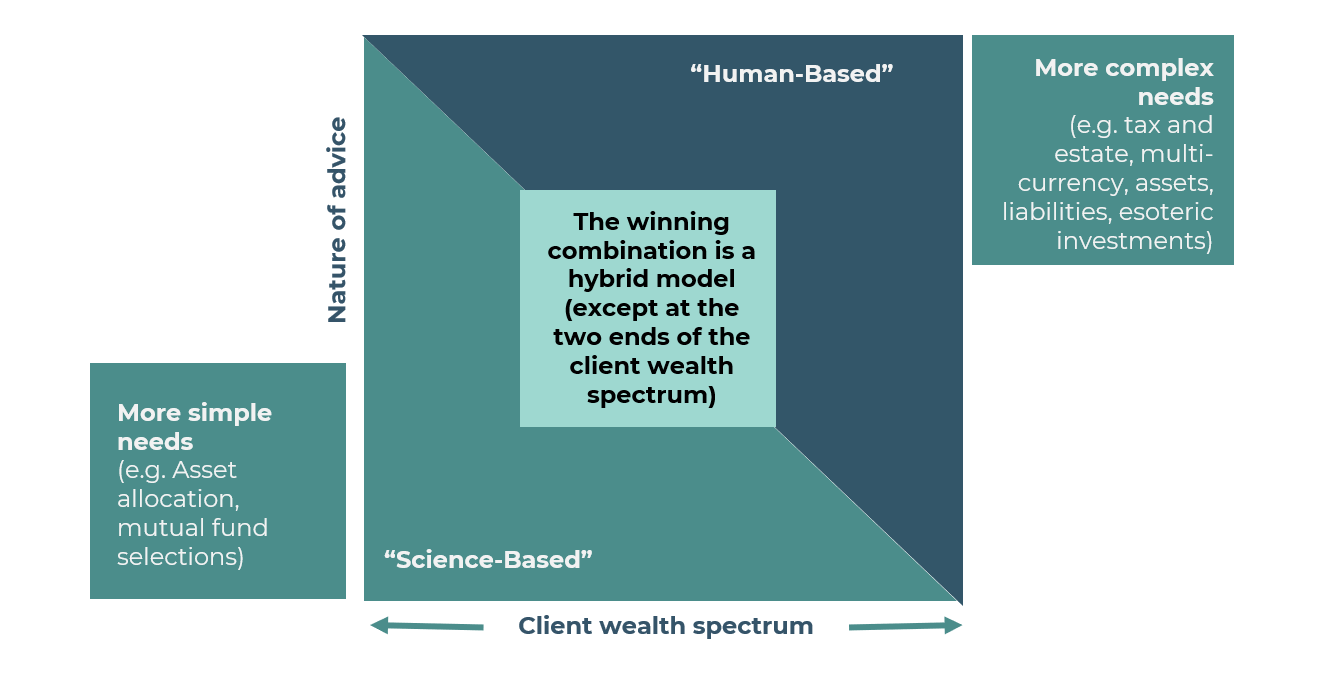

Source: Deloitte: Strategic Initiatives For Winning Using WealthTech

The discussions on the context for a Hybrid Service model revealed the ground has shifted: the need for digitisation has, in the past, been aligned to the wealth transfer and the coming of age of a younger demographic, potentially tempting firms to put their plans on ice for a few years yet. However, numerous industry research sources suggest the need for change is far more immediate. For example, 89% of investors say their preferred channel will be mobile apps within the next two years, while 66% of Millennials and 25% of Gen Xers and Baby Boomers’ want a self-directed investment portal with advisor access’.

The onboarding process was cited as an excellent example of how client expectations have changed. Increasingly losing patience with firms that fail to meet the new parameters for a seamless client experience, 68% of potential clients admitted they would ‘abandon onboarding processes if they are too time-consuming’ in a 2022 survey by Signicat.

“There is now a plethora of evidence that… clients will defect if digital

services are not available.”Benjamin Labrousse, Manager Pre-Sales, EMEA

Tackling internal resistance to change

Moderator Oliver Smith, Managing Editor, AltFi, inquired, given all the evidence and the apparent trajectory of digitisation and self-service, exactly where the internal resistance was coming from. The Wealth Dynamix expert concluded it tends to be less about the organisation’s size than the culture, with the biggest challenge to adopting their intelligent end-to-end CLM technology even today being spreadsheets as individuals cling to paper-based processes and their own data repositories. However, as stated above, many FAs plan to retire meaning this knowledge could be lost if client records remain on paper.

During the webinar, Benjamin Labrousse outlined some valuable tips for tackling internal resistance to change, including:

- Ensuring your approach is aligned with the strategic intent of the organisation and supported by a robust omnichannel strategy

- Formulating a cohesive business case supported by key metrics. If you are at the start of this process, Wealth Dynamix has a raft of supporting materials to help you in this task.

- Underlining the value of the Hybrid Service Model in building client trust, reducing manual processes and increasing operational effectiveness.

- Engaging teams early via the formulation of a change management project group to champion training and ensure maximum technology usage amongst staff.

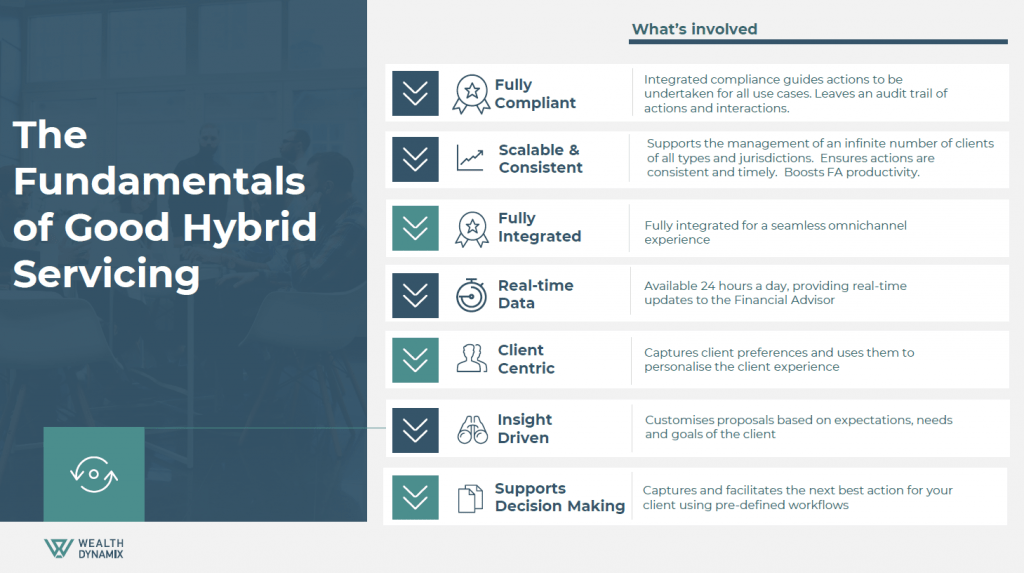

The Fundamentals of Good Hybrid Servicing

So what are the hallmarks of good hybrid servicing? Unsurprisingly, compliance was top of the list, with Benjamin Labrousse keen to press the importance of embedding compliance within Hybrid Service delivery, supported by real-time data accessible across every department. Anything less, he cautioned, will not achieve a clear omnichannel experience for the client or offer advisers next best actions in support of consistent service.

Benjamin Labrousse added that a Hybrid Service Model is often viewed as a step towards a loss of human interaction and depth of client insight – a very valid concern for Relationship Managers who wish to foster and maintain intuitive, profitable relationships with their clients. However, the reality is very different ‘when triggers and AI can combine to enable greater and deeper insights into clients’.

“There is a common misconception that the human aspect of service will be completely removed or eradicated…

In fact, one of the main benefits of Hybrid Servicing is freeing up the adviser’s time

by automating a lot of the manual processes that hinder efficiency and

allowing clients to undertake some of these tasks themselves….

which will all ultimately serve to benefit the client.”Benjamin Labrousse, Manager Pre-Sales, EMEA

The challenges of implementation

It was agreed that a highly personalised, tailored service lies at the heart of the future of wealth management yet embarking on a change management project takes considerable time and planning. The discussions then touched on some common pitfalls firms encounter at implementation stage, from thinking ‘the final step marks the end’ instead of acknowledging the need to evolve with the market to simply ‘bolting on new technology’ without fully integrating it.

The benefits of Hybrid Servicing

The benefits of the Hybrid Service model are clear as incumbent firms, and new entrants begin to leverage the advantages of

game-changing technology in support of a compliant, client-centric journey. From increased productivity and Assets Under Management to faster onboarding and time to revenue, the panel felt viewing ‘technology as an enabler’ and adopting a Hybrid Service model will be crucial to survival within a 5 to 10-year time frame. And if there’s one stat any CIO, CEO or Change Management Director should retain from the Altfi webinar, it is surely this:

Digital-first firms can serve a customer at around a third of the cost of traditional processes and, in some cases, as little as a sixth of the cost

Download the eBook: How Hybrid Servicing Can Transform Your Wealth Management Firm

Or to listen to the Altfi webinar on demand please click here.