Building a business case is critical to successfully delivering any technology project in the wealth management sector. Yet, according to Gartner, 35% of transformation projects fail to meet their business case. So how can you assure success, or at the very least, de-risk your transformation project?

Diving into the thorny topic in The Wealth Mosaic webinar discussions on 13 September 2022, a panel of experts sought to highlight the pitfalls and intricacies of the process. Here we share some top-level insights designed to help you keep your CLM business case on track.

The business context

In the current context of digital-first experiences and lower fees, the importance of the business case cannot be overstated. In short, “clients are becoming smarter and more demanding, seeking everything for less,” said William Rouse, Commercial Director UK, MEA & NA, Wealth Dynamix, accelerating the need for hybrid services and financial advice on demand.

As relationship managers strive to service more clients faster and more intuitively through a range of channels, it’s clear that technology has a critical role in supporting the modern wealth manager to succeed.

The role of the business case

A carefully constructed business case will set the scene and establish the proper framework for any technology and change project in wealth management, and it seems the process is speeding up, with Gartner noting that most businesses wish to conclude the business case element of a transformation process within 3 months. So how can you get it right?

Here’s some potted advice from the subject experts:

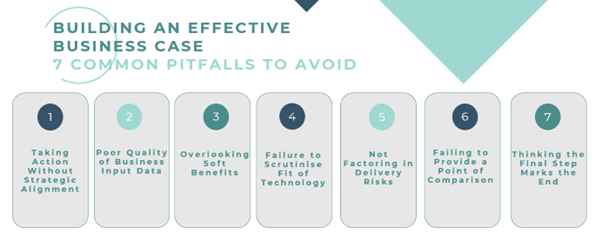

Know the pitfalls and avoid them

Knowing where the pitfalls lie from the outset will ensure you enter the business case-building stage with your eyes firmly open. The Wealth Dynamix e-book is a mine of information on the topic, helping you navigate the process with your focus on the desired business outcomes rather than rushing to define a solution. Johnny Beloe, Director of Pre-Sales at Wealth Dynamix, warned, “By definition, the business case exists to give the business confidence in a particular solution or business decision. If the business case process is flawed, it can, rather counterintuitively, increase confidence in the wrong business decision.”

Collaborate extensively

The topic of why the CLM business case is so complex was discussed during the webinar. The panel unanimously agreed that this is predominantly due to a CLM solution’s sheer breadth and ability to leverage savings at every stage of the client lifecycle. From engaging with prospects to onboarding, managing client accounts and compliance, it’s all relevant to delivering “the ultimate CLM”. It is, therefore, vital to collaborate, identifying relevant stakeholders across the organisation to ensure the solution’s potential benefits are accurately scoped through metrics that the various subject experts sponsor. The overriding message: no business case owner is an island!

Once the high-level benefits are agreed upon, Jonathan Keighley, MD of Shark Finesse, advised the next step should be to work through the detail of the revenue and cost-based benefits that are most likely to be sponsored and achieved. Benefits may not impact the business immediately so these will need to be phased accordingly. . A tool that can provide different views (optimistic v pessimistic), pivots for stakeholder views, and present delayed or phased benefits throughout the period of review will be hugely beneficial to differentiate between the different solutions on the table.

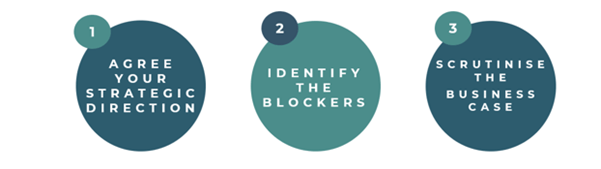

Play detective

Aligning teams behind the company’s strategic intent will likely have a unifying effect that will pay dividends throughout the business case process and onward to delivery. Speaking to all the key stakeholders will allow you to identify the blockers to your proposal. These may be financial (via internal competition for investment, for example), attitudinal or cultural. As mooted by William Rouse, knowing what they are is half the battle, enabling you to meet them head-on.

It is worth noting that often business cases require a separate innovation team to support the pulling together of the case with autonomy – and to champion the change, through the build and into implementation. This will ultimately aid adoption by employees and clients and help mitigate delivery risks.

Kick the tyres

At the final stage of the process, the panel encourage you to “kick the tyres and look beneath the bonnet of your business case.” Once the business case is complete, it can be tempting to think the hard work is done. However, all three experts emphasised ensuring the business case is as watertight as possible. Subjecting it to the scrutiny it warrants is sure to pay off when presenting it, enabling you to be prepared for any question or challenge.

Top 3 tips for success

To close, the Moderator for the session, Stephen Wall, Co-founder of The Wealth Mosaic, requested three top tips from the panel to unlock the value in their business case. Here’s how they responded:

Want to know more? See our Experts Insights article for a more detailed summary of the webinar discussions, including more top tips and advice from CLM and data experts.